alien & sedition.

Wednesday, August 22, 2007

Keep Your Eye on the Dolchstosslegende

This, to me, seems entirely beside the point. Matt Freeney agrees, pointing out the structural reasons why TNR hosts a range of opinions on the issue. He also invites Douthat to offer his own opinions on whether Kristol's buffoonish rants should be taken at face value, or seen as something a little more performative.

To my mind, authentic or not, the Dolchstoss discourse has the same effects. And what's peculiar is that Douthat himself has denounced it in the past:

William Kristol is an intellectually bankrupt thug. It's a point that hardly needs elaboration, but Jon Chait elaborates quite satisfyingly on it anyway, coming to a nice summation of the state of the Dolchstosslegende:

The theme of traitorous liberals is becoming a Standard trope. Last week's cover depicted an American soldier seen from behind and inside a circular lens--as if caught in the sights of a hostile sniper--beneath the headline, "does washington have his back?" The Weimar-era German right adopted the metaphor of liberals stabbing soldiers in the back. Kristol is embracing the metaphor of liberals shooting soldiers in the back. I suppose this is progress, of sorts.Ross Douthat objects to Chait's piece -- not on the merits, but because Chait's magazine, the New Republic, has never taken a coherent stance on the war.

There was a time when neoconservatives sought to hold the moral and intellectual high ground. There was some- thing inspiring in their vision of America as a different kind of superpower--a liberal hegemon deploying its might on behalf of subjugated peoples, rather than mere self-interest. As the Iraq war has curdled, the idealism and liberalism have drained out of the neoconservative vision. What remains is a noxious residue of bullying militarism. Kristol's arguments are merely the same pro-war arguments that have been used historically by right-wing parties throughout the world: Complexity is weakness, dissent is treason, willpower determines all.

This, to me, seems entirely beside the point. Matt Freeney agrees, pointing out the structural reasons why TNR hosts a range of opinions on the issue. He also invites Douthat to offer his own opinions on whether Kristol's buffoonish rants should be taken at face value, or seen as something a little more performative.

To my mind, authentic or not, the Dolchstoss discourse has the same effects. And what's peculiar is that Douthat himself has denounced it in the past:

Myself, I think that liberals should be praying that the Right embraces the "stabbed in the back" theory of what went wrong in Iraq (and possibly Iran as well), because it will push conservatives toward political irrelevance. Yes, many conservatives have long nursed the belief that we could have won in Vietnam if liberals hadn't turned gutless and anti-American, but this belief hasn't won the Right any elections ...This is a pragmatic argument, not a principled one, though there's no reason to believe that Douthat has any sympathy for Dolchstoss talk on any level. Maybe he was simply using Chait's piece as an opportunity to grind an axe over TNR's editorial policy. But it sure would be nice if he, as a conservative, would also take the opportunity to denounce the thuggery of his ideological cousin.

So when Dinesh D'Souza tells conservative cruisegoers that "it's customary to say we lost the Vietnam war, but who's 'we'? ... The left won by demanding America's humiliation," he isn't broadening conservatism's base - he's shrinking it. Which is what a post-Bush conservatism that obsesses over how the liberal media undid the Iraq Occupation by failing to "report the good news" would do as well.

Labels: Dolchstosslegende, Jonathan Chait, Ross Douthat, William Kristol

Monday, April 23, 2007

The Persistence of the Low Road

The specific debate has to do with the tax code, and the honest - and surprisingly moderate - analysis comes from the American Enterprise Institute's Kevin Hassett. Now I'm about the last person on earth to accuse AEI of objectivity or moderation, but Hassett's article quite reasonably uses economic data and historical analysis to make two important points about the tax code: that it is 1) Not very progressive, but 2) Not particularly controversial, either.

The second point is the larger one, and what he means by it is simply that modern Americans are quite comfortable with the fact that roughly 30% of their income goes to taxes, since those taxes pay for the public goods that Americans expect government to provide. Hassett points out that the tax rates that drove our founding fathers to revolt added up to a whopping total of about 2 percent of their income. Conservative anti-tax warriors tend to appropriate that revolutionary rhetoric to combat a modern tax system which they view as a monstrosity; Hassett, to his credit, observes that the great majority of Americans simply don't agree.

Even more to his credit is his analysis of an aspect in which the modern tax code should be more controversial: its hidden regressivity:

So the hackdom comes in Ari Fleischer's Wall Street Journal op-ed, in which the former Bush flack ludicrously claims that the wealthy are paying an unfair share of taxes compared to the freeloading poor. Douthat points to Jonathan Chait's evisceration of Fleischer's piece, and it's a good read (especially if you don't have a subscription to the Journal). Chait mocks Fleischer's basic mathematical incompetence, and goes on to point out that Fleischer is dishonestly using income tax data alone to make his claim - thus ignoring the numerous other forms of taxation which, as Hassett points out, wind up forcing the working class to pay as much as the rich. And it doesn't stop there:

Ross Douthat points out an interesting example of a contrast in conservative intellectual syles: call it honesty vs. hackdom.

The specific debate has to do with the tax code, and the honest - and surprisingly moderate - analysis comes from the American Enterprise Institute's Kevin Hassett. Now I'm about the last person on earth to accuse AEI of objectivity or moderation, but Hassett's article quite reasonably uses economic data and historical analysis to make two important points about the tax code: that it is 1) Not very progressive, but 2) Not particularly controversial, either.

The second point is the larger one, and what he means by it is simply that modern Americans are quite comfortable with the fact that roughly 30% of their income goes to taxes, since those taxes pay for the public goods that Americans expect government to provide. Hassett points out that the tax rates that drove our founding fathers to revolt added up to a whopping total of about 2 percent of their income. Conservative anti-tax warriors tend to appropriate that revolutionary rhetoric to combat a modern tax system which they view as a monstrosity; Hassett, to his credit, observes that the great majority of Americans simply don't agree.

Even more to his credit is his analysis of an aspect in which the modern tax code should be more controversial: its hidden regressivity:

Government has been robbing Peter to pay Peter. The similarity between the tax proportion for the high-income family and that of the middle-income family will surprise many. That's because the federal income tax, which is steeply progressive -- the higher your income, the more you pay in taxes -- gets all the media attention. But other taxes that are less visible, such as sales taxes, hit lower-income families with a heavy thud and quickly fill in the gap between their lower federal income taxes and the higher rates paid by those with high incomes.This is an important insight: not only does it illustrate how absurdly regressive our tax code has become - families earning $50,000 pay the same amount in overall taxes as those earning $150,000 - it reveals the political sleight-of-hand that has brought this situation to pass. Of course, Hassett's conservative perspective still comes through: one could re-write the paragraph I emphasized above to point out that "politicians get to pretend that they are virtuously cutting middle-class taxes, and they can maintain that fiction without sacrificing the economic interests of their wealthy supporters." But the formula is the same.

This is evident in the calculations that went into this chart. The federal income tax in 2003 for the family earning $50,000 was about $3,800, whereas it was about $17,500 for the family bringing in $150,000. But everything else worked to more than offset this difference. Middle-class families spent a larger share of their income and thus paid more sales tax. Gasoline and property taxes also ate up a larger share of the middle-class family's budget. Finally, the payroll tax is limited to 15.3 percent of income, so the wealthy paid a smaller share.

Governments at all levels have voracious appetites for cash, but taking revenue from the middle class is a politically risky maneuver; after all, that's where the votes are. So lawmakers have crafted ingenious ways around the dilemma, imposing hefty levies on those with lower incomes but relying on stealth taxes to do it. If you're going to tax widows and orphans, you'd better be quiet about it; use a sales tax.

Government thus takes more from the wealthy through income taxes, but extracts more from the poor with all the other taxes. By doing this, politicians get to pretend that they are virtuously redistributing wealth from the richer to the poorer, and they can maintain that fiction without sacrificing the cash. Voters seem to like this approach.

So the hackdom comes in Ari Fleischer's Wall Street Journal op-ed, in which the former Bush flack ludicrously claims that the wealthy are paying an unfair share of taxes compared to the freeloading poor. Douthat points to Jonathan Chait's evisceration of Fleischer's piece, and it's a good read (especially if you don't have a subscription to the Journal). Chait mocks Fleischer's basic mathematical incompetence, and goes on to point out that Fleischer is dishonestly using income tax data alone to make his claim - thus ignoring the numerous other forms of taxation which, as Hassett points out, wind up forcing the working class to pay as much as the rich. And it doesn't stop there:

Fleischer waxes indignant about how the top 1 percent is paying a higher share of the tax burden than it was 25 years ago. The reason this is true, of course, is that the top 1 percent is earning a far higher share of the national income.Fleischer insists it's because they're paying higher tax rates. He cites a study last year by CBO which, he says, shows that since 1979, the "[The top 1 percent] share of the nation's income has risen, but their tax burden has risen even faster."As refreshing as it is to see honest analysis of an important issue by a conservative like Hassett, it's deeply depressing that hacks and liars like Fleischer are not only considered equally important voices, but are actually governing this country. I'm glad Douthat demands a higher standard from conservative discourse; I wish more of his compatriots would do the same.

I found that study, and it shows just the opposite of what Fleischer says. In 1979, the highest-earning 1 percent of taxpayers paid an effective federal tax rate of 37 percent. In 2004, they paid an effective federal tax rate of 31.1 percent.

Labels: Ari Fleischer, Jonathan Chait, Kevin Hassett, taxes

Thursday, March 29, 2007

"Like Hemophiliacs with Chainsaws"

Jonathan Chait tracks the bloody recriminations on the right over Rudy's flat tax flip-flop.

Labels: conservatives, flat tax, Jonathan Chait, Rudy Giuliani

Monday, March 26, 2007

All Your Reality Base Are Belong to Us

Chait notes that several Republican Congressmen who do take global warming seriously - Reps. Wayne Gilchrest, Roscoe Bartlett, and Vernon Ehlers - were recently turned down by the Republican leadership for seats on the Select Committee on Energy Independence and Global Warming. Bartlett and Ehlers are research scientists. Observes Chait, "Normally, relevant expertise would be considered an advantage. In this case, it was a disqualification."

So on a critical issue - and at a criticial juncture - we find, once again, Republicans failing in their duty to provide constructive leadership because of the overriding conservative refusal to believe in the utility of science or activist government. The qualified members of their own party are undermined by the ideologues. John Boehner knows which side his freedom toast is buttered on - that's why he turned up at the conservative summit to grovel before the very same "intellectuals" who insist that climate change is a liberal fairy tale. They're driving the movement, and the movement is driving the party.

Still, if you understand conservative dynamics and know how to manipulate them, you can use them to your advantage. Thus, Chait points out, John McCain's efforts to address climate change center on his advocacy of nuclear power. Whatever you think of nuclear plants, you have to admire the political insight here:

Good piece by Jonathan Chait at the LA Times yesterday: "Why the Right Goes Nuclear over Global Warming." It's a quick look at the dynamics behind the perverse fact that, as evidence for global warming goes stronger, Republican politicians are actually getting more skeptical. As Chait points out, it's a process largely driven by a small number of hard-core denialist ideologues (the very same ones we cover regularly at this blog):

Your typical conservative has little interest in the issue. Of course, neither does the average nonconservative. But we nonconservatives tend to defer to mainstream scientific wisdom. Conservatives defer to a tiny handful of renegade scientists who reject the overwhelming professional consensus.Emphsis mine. Once again, culture war trumps all.

National Review magazine, with its popular website, is a perfect example. It has a blog dedicated to casting doubt on global warming, or solutions to global warming, or anybody who advocates a solution. Its title is "Planet Gore." The psychology at work here is pretty clear: Your average conservative may not know anything about climate science, but conservatives do know they hate Al Gore. So, hold up Gore as a hate figure and conservatives will let that dictate their thinking on the issue.

Chait notes that several Republican Congressmen who do take global warming seriously - Reps. Wayne Gilchrest, Roscoe Bartlett, and Vernon Ehlers - were recently turned down by the Republican leadership for seats on the Select Committee on Energy Independence and Global Warming. Bartlett and Ehlers are research scientists. Observes Chait, "Normally, relevant expertise would be considered an advantage. In this case, it was a disqualification."

So on a critical issue - and at a criticial juncture - we find, once again, Republicans failing in their duty to provide constructive leadership because of the overriding conservative refusal to believe in the utility of science or activist government. The qualified members of their own party are undermined by the ideologues. John Boehner knows which side his freedom toast is buttered on - that's why he turned up at the conservative summit to grovel before the very same "intellectuals" who insist that climate change is a liberal fairy tale. They're driving the movement, and the movement is driving the party.

Still, if you understand conservative dynamics and know how to manipulate them, you can use them to your advantage. Thus, Chait points out, John McCain's efforts to address climate change center on his advocacy of nuclear power. Whatever you think of nuclear plants, you have to admire the political insight here:

In reality, nuclear plants may be a small part of the answer, but you couldn't build enough to make a major dent. But the psychology is perfect. Conservatives know that lefties hate nuclear power. So, yeah, Rush Limbaugh listeners, let's fight global warming and stick it to those hippies!It's not exactly reverse psychology. Call it perverse psychology.

Labels: conservatives, global warming, John McCain, Jonathan Chait

Saturday, February 03, 2007

The Embarassing Question of Inequality

When forced to talk about inequality, conservatives will respond with two broad claims:

There's no serious dispute over whether inequality is increasing in America. Chait cites the work of Thomas Piketty and Emmanuel Saez, which uses tax return data to show that, as Chait describes it, "Since 1980, the share of income accruing to the highest-earning 1 percent of U.S. tax returns doubled, the share of the top one-tenth of 1 percent tripled, and the share of the top one-hundredth of 1 percent quadrupled." Meanwhile, as Paul Krugman recently pointed out, "Median real income was only about 23 percent higher in 2005 than in 1976."

Thus conservatives retreat to their fallback position: Yeah, but so what? Tyler Cowen - drawing on claims by Alan Reynolds - made this argument in a recent New York Times op-ed:

But, as Bradford Plumer explains in another article at the New Republic, it already is threatening the system: it's undermining American democracy:

But economic inequality is also unjust in and of itself, independent of its effects on other institutions. Cowen tries to dance around this conclusion, arguing that, inasmuch as inequality has increased, it has been for innocuous reasons:

The problem for Cowen's argument is that, again, the explosive growth in income has occurred in the top 1 percent of tax filers. Inequality happens most dramatically across the divide between the wealthiest one percent and everyone else. This has nothing to do with the broad segments of the American population that are elderly or educated. Cowen's attempt at bamboozlement is laughable. This is about how a very small number of elites have a massively disproportionate amount of the national wealth compared to the other 99% of us.

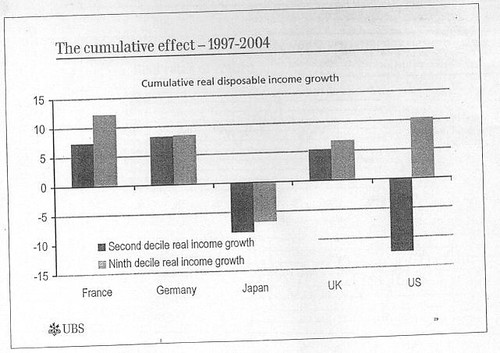

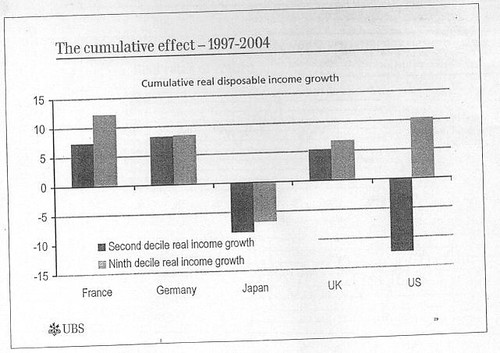

For context, let's look at the graph Jerome a Paris posted at Daily Kos:

Now, this graph expands the upper income bracket to the top 10% of the population, but it still makes a striking point, one that can't be dismissed with excuses about the educated or the elderly - and anyway, don't Europeans have educated and elderly folks too?

A very small number of elites in America have wealth in massive disproportion to the rest of America. Even so: Fine, the conservatives say. That's still not inherently unjust, because it's not a zero-sum game. As long as everyone's boats are being lifted, it doesn't matter if some people's boats go a lot higher than everyone else's.

But it is unjust. As productivity has grown, so has inequality. American workers are making the pie larger, but American elites are getting most of the benefit. The Economic Policy Institute recently reported on this phenomenon:

Conservatives don't want to talk about this, and in recent years liberals have far too often politely obliged. Jim Webb took the gloves off, and it's about time. We have to stop coddling these people.

Judging by a number of remarks I heard throughout the weekend at the Conservative Summit, Jim Webb's response to the State of the Union really grinded a lot of conservative gears. One reason for this is that Webb went hard after an issue that conservatives very much don't want to talk about: economic inequality.

When forced to talk about inequality, conservatives will respond with two broad claims:

- Inequality is not really increasing

- Even if it is increasing, it doesn't matter.

There's no serious dispute over whether inequality is increasing in America. Chait cites the work of Thomas Piketty and Emmanuel Saez, which uses tax return data to show that, as Chait describes it, "Since 1980, the share of income accruing to the highest-earning 1 percent of U.S. tax returns doubled, the share of the top one-tenth of 1 percent tripled, and the share of the top one-hundredth of 1 percent quadrupled." Meanwhile, as Paul Krugman recently pointed out, "Median real income was only about 23 percent higher in 2005 than in 1976."

Thus conservatives retreat to their fallback position: Yeah, but so what? Tyler Cowen - drawing on claims by Alan Reynolds - made this argument in a recent New York Times op-ed:

The broader philosophical question is why we should worry about inequality — of any kind — much at all. Life is not a race against fellow human beings, and we should discourage people from treating it as such. Many of the rich have made the mistake of viewing their lives as a game of relative status. So why should economists promote this same zero-sum worldview? Yes, there are corporate scandals, but it remains the case that most American wealth today is produced rather than taken from other people.Ramesh Ponnuru makes the same argument in the February 12 edition of the National Review, which was published to accompany the Summit:

What matters most is how well people are doing in absolute terms. We should continue to improve opportunities for lower-income people, but inequality as a major and chronic American problem has been overstated.

Conservatives generally think that an unequal distribution of wealth and income is not, per se, a bad thing [...]In other words, inequality is not unjust, so it should only be a concern when it has the practical effect of threatening the system itself.

We should care about reducing the number of people living in poverty ... But inequality should matter only if it reaches the point where it threatens popular support for a market economy. It is nowhere near that point. [Print only: p. 22]

But, as Bradford Plumer explains in another article at the New Republic, it already is threatening the system: it's undermining American democracy:

Over the last few years, political scientists have been converging on the view that massive disparities in wealth and income really do distort the democratic process--by allowing a tiny segment of the population to wield outsized influence in the political realm.The wealthy, Plumer points out, vote more (perhaps because they feel the system responds to them), make more political donations (which dramatically increases access to policymakers), and are almost exclusively represented in the ranks of elected officials. The result is a situation in which an activist government actually works for the elites, distributing wealth upwards. This broad imbalance in democratic representation means that some citizens end up being more equal than others. If inequality is left unchecked, "the very idea of 'equal citizenship' will continue its long erosion."

But economic inequality is also unjust in and of itself, independent of its effects on other institutions. Cowen tries to dance around this conclusion, arguing that, inasmuch as inequality has increased, it has been for innocuous reasons:

Much of the measured growth in income inequality has resulted from natural demographic trends. In general, there is more income inequality among older populations than among younger populations, if only because older people have had more time to experience rising or falling fortunes.Thus, inequality comes about mostly thanks to "relaxed bohemians" in their yurts, and old folks unable to stop buying all that crap on HSN.

Furthermore, more-educated groups show greater income inequality than less-educated groups. Uneducated people are more likely to be clustered in a tight range of relatively low incomes. But the educated will include a greater range of highly motivated breadwinners and relaxed bohemians, and a greater range of winning and losing investors. A result is a greater variety of incomes. Since the United States is growing older and also more educated, income inequality will naturally rise.

The problem for Cowen's argument is that, again, the explosive growth in income has occurred in the top 1 percent of tax filers. Inequality happens most dramatically across the divide between the wealthiest one percent and everyone else. This has nothing to do with the broad segments of the American population that are elderly or educated. Cowen's attempt at bamboozlement is laughable. This is about how a very small number of elites have a massively disproportionate amount of the national wealth compared to the other 99% of us.

For context, let's look at the graph Jerome a Paris posted at Daily Kos:

Now, this graph expands the upper income bracket to the top 10% of the population, but it still makes a striking point, one that can't be dismissed with excuses about the educated or the elderly - and anyway, don't Europeans have educated and elderly folks too?

A very small number of elites in America have wealth in massive disproportion to the rest of America. Even so: Fine, the conservatives say. That's still not inherently unjust, because it's not a zero-sum game. As long as everyone's boats are being lifted, it doesn't matter if some people's boats go a lot higher than everyone else's.

But it is unjust. As productivity has grown, so has inequality. American workers are making the pie larger, but American elites are getting most of the benefit. The Economic Policy Institute recently reported on this phenomenon:

Data from the Bureau of Economic Analysis through the third quarter of 2006 show that a historically high share of corporate income is going into profits and interest (i.e., capital income) rather than employee compensation. And a newly released Congressional Budget Office (CBO) analysis of household incomes shows that a greater share of this capital income goes to the richest households than at any time since the CBO began tracking such trends. In other words, our economy is producing more capital income and that type of income is more likely to go to those at the very top of the income scale.This, despite what conservatives would like us to believe, is unjust. It is unjust when American workers, the most productive in the world, create additional wealth only for that wealth to be sucked away into corporate profits. If my hard work is rewarded by a situation where my boat rises only a little bit, so that your boat can rise a lot, then an injustice has been done. It is a zero-sum equation.

Conservatives don't want to talk about this, and in recent years liberals have far too often politely obliged. Jim Webb took the gloves off, and it's about time. We have to stop coddling these people.

Labels: Bradford Plumer, conservatives, economics, inequality, Jonathan Chait, The New Republic, Tyler Cowen